Maui Vacation Rentals

Vacation Rentals have been a part of Maui’s visitor industry accommodations since the 60’s. In 1964 the condo regime legislation was enacted, by 1970 Maui had 17 resort condominium projects. In 1997 the county created the permitting system for Bed and Breakfast homes through Maui County Ordinance 19.64, then expanded the process by broadening its application. Then in 2013 the county furthered the diversification of visitor accommodations with ordinance chapter 19.65 creating the permitting system for legal short term rental homes.

By 2020 Vacation Rentals are the number one source of revenue for Maui County in Real Property Taxes, and has been for the last three years. In fiscal year 2020 about 14 cents of every dollar budgeted in Maui County came from vacation rentals. Short term rentals were mandated to be closed due to COVID 19 during 2020.

To Note also for FY2020:

Time Share Properties were number 8 with $40 million

Homeowners were number 9 with $33.09 million

Hotel & Resort Property were number 10 with $33.08 million

With a robust legal transient accommodation market, Maui has managed to close in on one of Hawaii’s industry goals: attracting the high spending visitor, while having the lowest visitor count in comparison to the other counties. In 2019 24% of all visitors to Hawaii stayed in vacation rentals, a substantial portion of the market.

When comparing counties, Maui had the lowest share of vacation rental visitor arrivals at 30%. However Maui County vacation rental visitors generated the largest amount of spending of all the counties at $1.5 billion. 55 percent of that was non lodging spending, or $775 million. Of that $321 million was spent on food and drink, $177 million spent on transportation, and $130 million each was spent on shopping with $128 on entertainment.

The vacation rental guests as a whole spent an estimated $4.4 billion dollars, and that represented nearly a quarter of all visitor spending in the state. In 2019 Maui county also generated $207,773,430 in TAT revenue for the state, about 33% of the overall Transient Accommodations Tax collected in that year.

Condo and Vacation Rental Visitors spent more over their stays in 2019, with averages of $3800, and $3400 respectively.

Maui County Planning Department has stated that their enforcement division has illegal rentals under control. Planning Director Michele McLean estimates that there are just a handful of illegal entities left around 35 at the end of 2019.

Source: Maui Planning Department; Maui County 2019 Transient Rental Enforcement Summary

Short term rental homes make up around 220 homes of the 54,479 (per last US census) households on Maui. This is 1 in 248 homes. Maui's STRH permit program has built in safeguards against vacation rentals affecting home values. Only people who have owned their home for five or more years can apply. New home owners are not able to apply for a permit. All legal vacation rental homes have signs out front, with contact phone information and permit numbers. The permitting scheme has worked well to keep the health and character of neighborhoods intact, while also contributing to the revenue stream of the county.

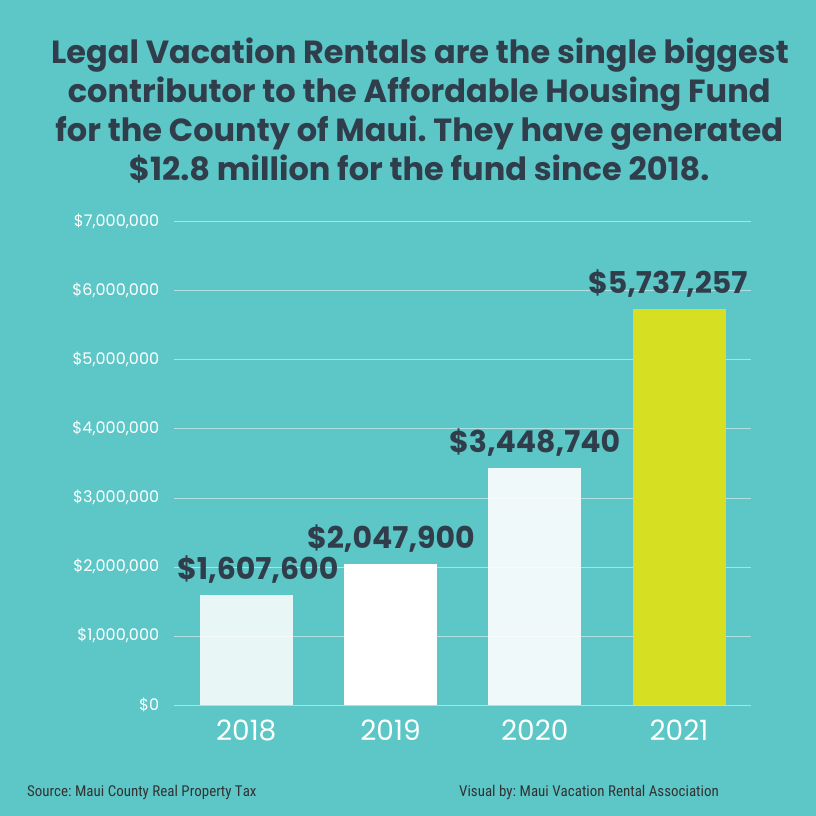

Vacation rentals are also the single biggest contributor to the Affordable Housing Fund for the County of Maui. They have generated $12.8 million for the fund since 2018.

The visitor accommodations sector generated $189 million for the county in fiscal year 2020-2021, approximately 50% of the county real property tax revenue. Of that Short term rentals generated $114 million, about 62%. Short term rentals and bed and breakfast operations were also mandated to be closed during 2020 due to COVID 19, and were not able to apply for any county CARES relief funding.

Infographics and report compiled by Maui Vacation Rental Association (MVRA)

About Maui Vacation Rental Association

We are a membership based non profit organization working on the advocacy and affairs of the vacation rentals in Maui County. Our members are condo owners, bed and breakfast operators, short term rental owners, realtors, brokers, managers and affiliated businesses. The work we do protects property rights, gives our members a voice, and we also share information and news on the industry. We are members of Hawaii Visitor and Convention Bureau, and the Maui Hotel and Lodging Association, as well as Maui Chamber of Commerce.

https://www.instagram.com/mauivacationrentalassociation/

https://www.facebook.com/MauiVacationRentalAssociation

https://twitter.com/maui_rentals

https://www.pinterest.com/MauiVacationRentalAssociation

Sources:

Classification of Residential Visitor Lodging Properties, IAAO Conference, By Marcy Martin, AAS, County Real Property Tax Administrator. 9/8/2019

Housing and Human Concerns Annual report, 2020

https://www.mauicounty.gov/DocumentCenter/View/116779/050-08-Housing-and-Human-Concerns-REVISED

County of Maui Comprehensive Economic Development Strategy Report, December 2016

Maui County 2019 Transient Rental Enforcement Summary

TAT tax figures: https://tax.hawaii.gov/stats/a5_3txcolrptarchive/

Visitor Statistics: https://www.hawaiitourismauthority.org/media/5062/2019-annual-report-final-for-posting.pdf

Real Property Tax: https://www.realpropertyhonolulu.com/rpa-report/#2020

Kloninger & Sims Travel Tech Report 2019, https://files.constantcontact.com/983c3589001/19f3de90-a494-4d87-a405-1ade1a633fe5.pdf

Image of wailea: By Ekrem Canli - Own work, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=61642575,